如果您收到了加拿大税务局(Canada Revenue Agency,简称CRA)关于个人报税的抽查信(Review Letter),应该如何处理?别担心,接下来我们会逐一解答您的疑惑。

首先,我们需要明确的是,收到CRA的抽查信并不代表您有什么问题,也不应该产生不必要的恐慌。税务局会定期进行一些抽查,以确认公民的税务申报是否准确。所以,只要您的税务申报是诚实准确的,就无需担忧。

接下来,我们一起看看应对税务局抽查(CRA Review)的几个关键步骤。

第一步:阅读并理解信件内容

总的来说,收到任何一封CRA信件,都需要及时查看并阅读全文。还没有注册CRA My Account?

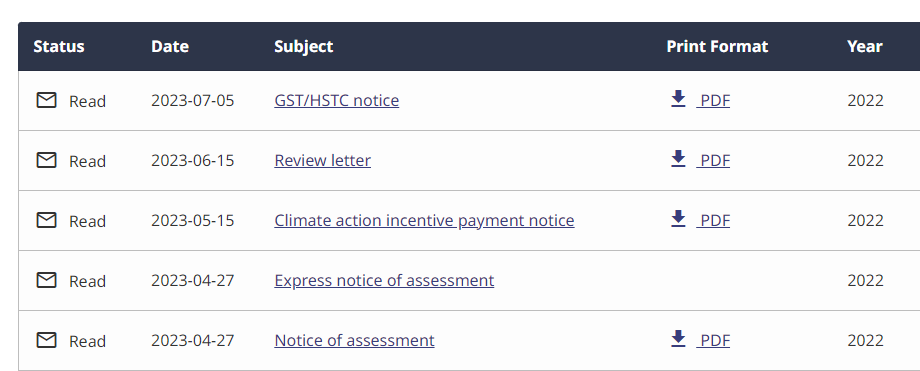

首先,CRA常见的信件标题有几下几种:

- 个人所得税评估通知 Notice of assessment

- 个人所得税评估预估通知 Express notice of assessment

- 消费税补贴通知 GST/HSTC notice

- 安省住房补贴通知 OTB notice

- 气候补贴通知 Climate action incentive payment notice

- 抽查信 Review Letter

评估通知 NOA 和 Express NOA

NOA 和 Express NOA 通常无需回复,除非您对审理结果不认可。

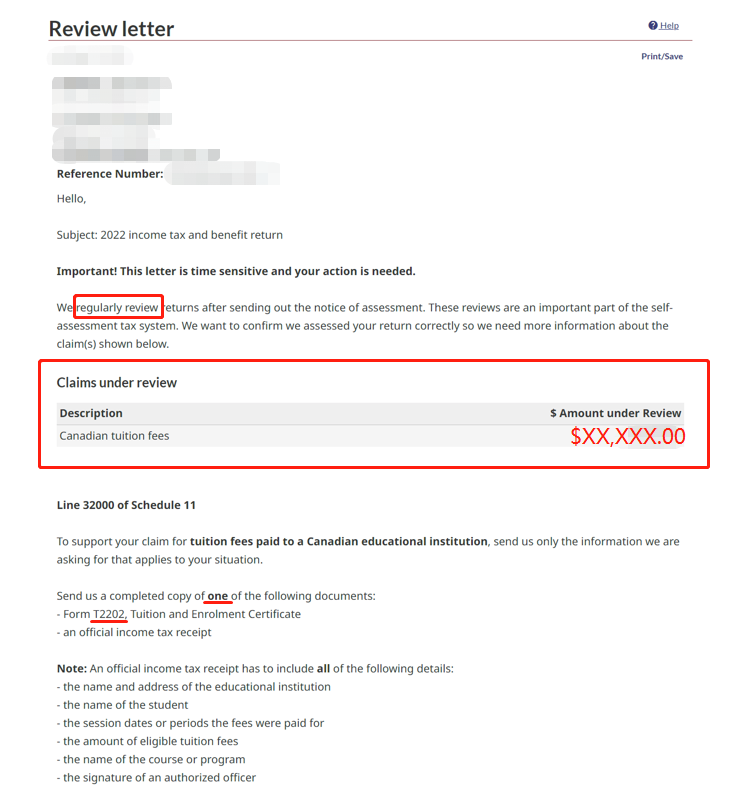

抽查信 Review Letter

抽查信 Review Letter 通常必须在30天内作出回复。常见的抽查内容有:学费、房租/地税、医疗费用等。通常信中会包含案件号 Case Number, 用于准确回复该案件。以下图学费抽查为例,“regularly review”表示您被随机抽查到了,需要向CRA提供学费单T2202,数字需要与您报税时申报的数字保持一致。

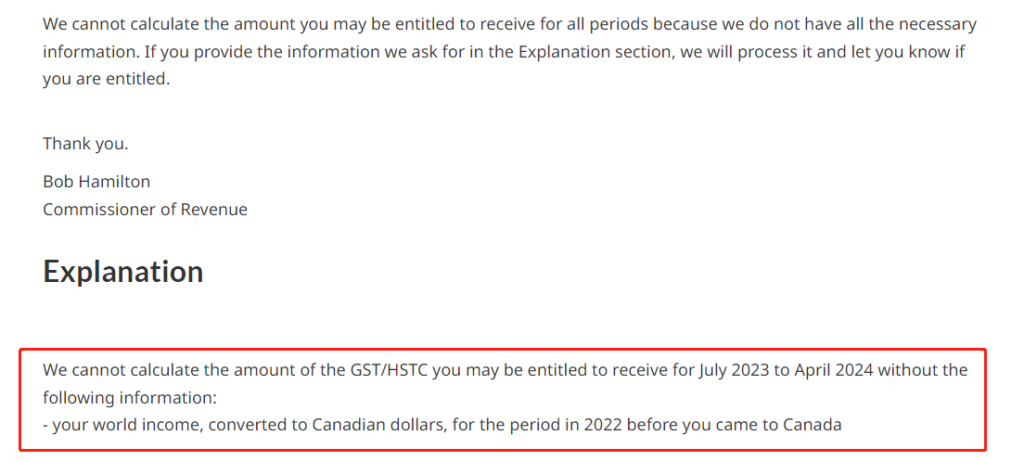

补贴 Notice

补贴 Notice 一定要认真查看,一般是通知福利发放结果,但如果需要补充信息,也很可能需要回复。以下图GST/HST notice 为例,信中说:无法计算您的GST/HST福利,因为CRA还没有收到您的全球收入信息。

第二步:CRA Review 准备需要的文件

开始准备CRA所要求的文件。如果信中提到的文件您不能立即找到,一定要尽快开始查找或联系文件颁发机构。

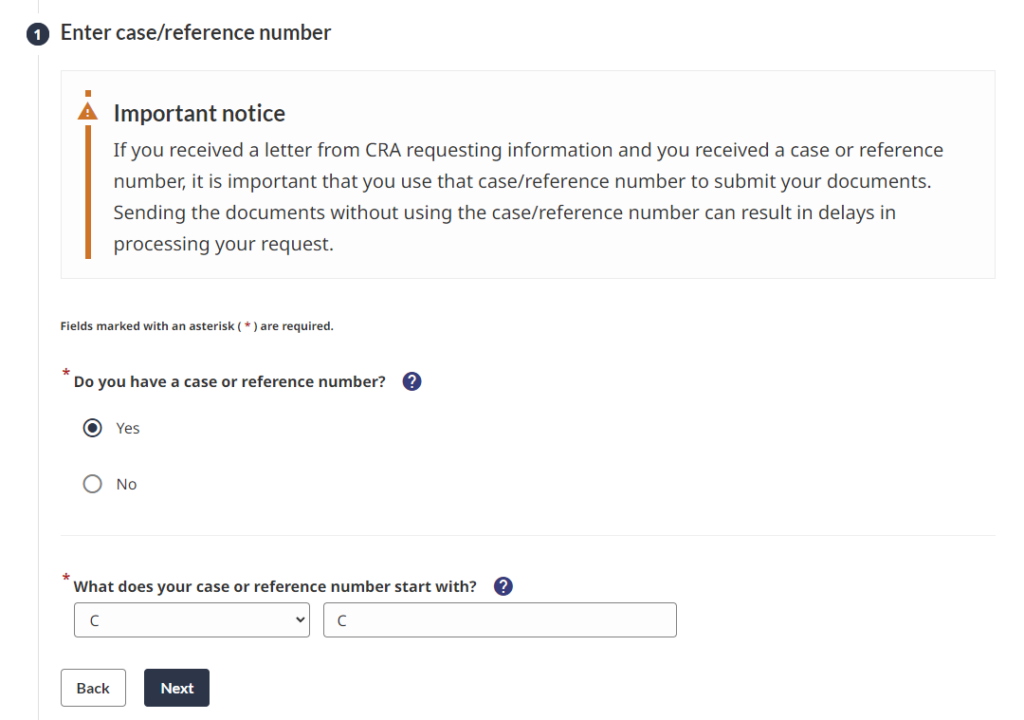

如果需要回复 Review Letter,可以在线回复:

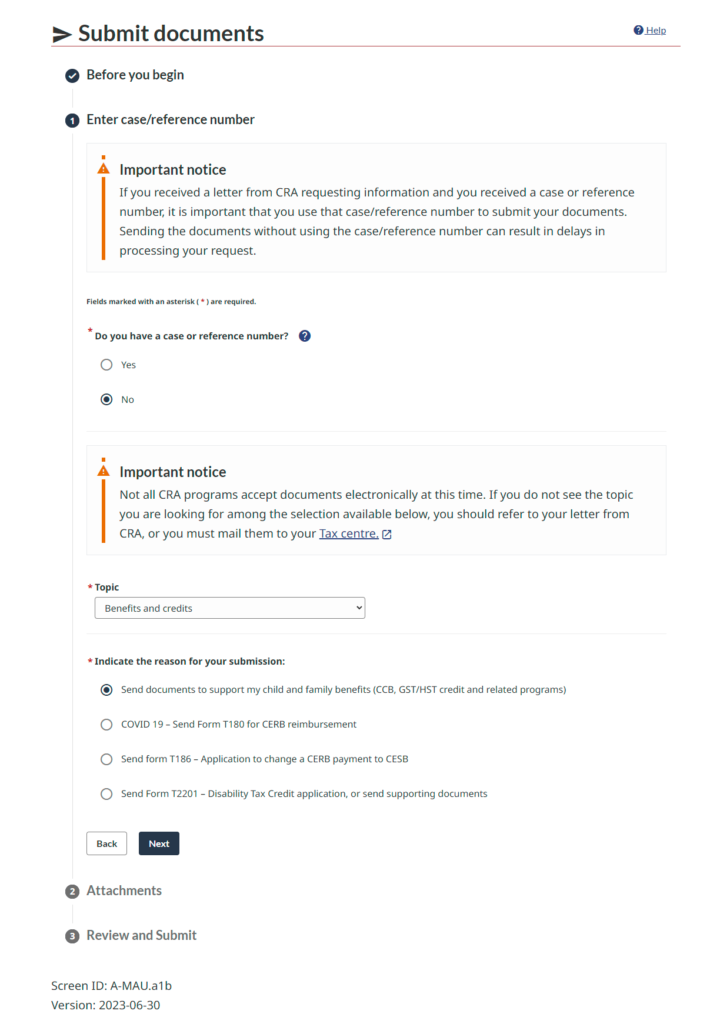

- 登录CRA后,在页面左边选择“Submit documents”

- 进入后再选择“Submit documents”

- “Do you have a case or reference number?” 回答 Yes, 并填写Review Letter中左上角的号码。

- 根据步骤上传所需文件即可。

- 上传成功后,保存confirmation页面。

如果需要提供全球收入 (World Income) 情况,可以有两种回复方式:

- 最快的方式是:致电税务局福利部门,直接回复:1-800-387-1193,或者

- 在文本中回复,并在CRA账户中上传文本,步骤如下:

- 登录CRA后,在页面左边选择“Submit documents”

- 进入后再选择“Submitt documents”

- 按下图勾选。

- 上传文本,并提交。

- 保存Confirmation页面。

举个例子,以上面2022 的 GST/HSTC notice为例:

零收入的人可以这样回复:

To whom it may concern,

I received a GST/HSTC notice letter, asking me to provide my world income, converted to Canadian dollars, for the period in 2022 before I came to Canada. Here is my response.

I do not have any income for the period in 2022 before I came to Canada.

Please let me know if you need anything else.

Regards,

XXX

有收入的人可以这样回复:

To whom it may concern,

I received a GST/HSTC notice letter, asking me to provide my world income, converted to Canadian dollars, for the period in 2022 before I came to Canada. Here is my response.

I came to Canada and became a Canadian resident for tax purposes on July 1st, 2022. I earned xxxxx CNY (China Yuan) in 2022 before coming to Canada, converted to Canadian Dollars, which is $xxxxx CAD, calculated using the average 2022 exchange rate of 0.19 provided by CRA.

Please let me know if you need anything else.

Regards,

XXX

第三步:在截止日期前提交文件

通常,Review Letter 的回复时间是30天;福利 notice 的回复虽然没有明确规定时间,但是只有当CRA处理好回复后,才会发放福利,所以应当在收到信后尽快回复。

第四步:考虑寻求专业帮助

如果您对CRA的要求感到困惑,或者不确定如何准备文件,可以考虑寻求专业的税务顾问或会计的帮助。

第五步:保持沟通

如果您无法在截止日期前提交所需的文件,或者需要更多的时间来准备,建议您尽早与CRA联系,说明情况,请求延期。同时,保存所有与CRA的通信记录,包括发送的信件和电子邮件,以及接收的任何回复。在您提交的所有文件中都保存副本。这样,如果有任何问题或争议,您将有完整的记录可以参考。

无论是对税务有多么熟悉,每年的税务申报都是一项重要的责任。收到CRA的抽查信,其实并不可怕。只要遵循正确的步骤,并在需要时寻求专业帮助,就能顺利应对。希望这篇文章能帮助大家更好地理解如何处理CRA的抽查信。如果有任何其他的问题,欢迎联系我们。