CRA官方在线付款链接:https://apps.cra-arc.gc.ca/ebci/fppp/mypymnt/pub/ntr.action?request_locale=en_CA

CRA在线付款六步

- 选择 Payroll source deductions

- 这里我们以regular remittance为例

- 填写信息

- 确认所付账户,账号,总工资,员工数,周期,和金额

- 了解并选择支付方式,输入登录信息或卡号

- 付款成功,保存付款记录

Regular remittance: 每月申报一次的企业,按时缴纳工资税

Quarterly remittance: 每三个月申报一次的企业,按时缴纳工资税

Balance due: 用于支付当前,上一次,或之前年份,未评估的未清余额。

Arrears remittance: 用于支付以评估的欠款,包括支付罚款和利息。

Payment on filing: 用于支付在截止前,还未付清的差额。例如,2021年所交工资税与2021的T4总数有出入,那么在2022年2月28日前缴纳差额,需选择payment on filing进行付款。

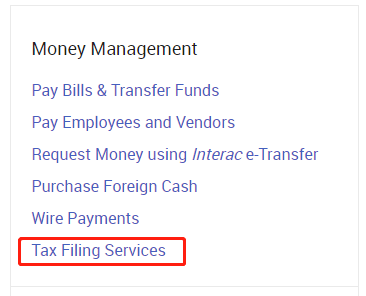

网银在线付款六步

每个银行可能稍有不同,这里以RBC为例:

- 打开电脑,在网页登录银行账户

- 在“Tax Filing Services”里,添加关键字“Regular/Quarterly – EMPTX – (PD7A)”

- 根据我们提供的付款表格填写信息

- 确认所付账户,账号,总工资,员工数,周期,和金额

- 提交

- 付款成功,保存付款记录