Non-resident

Expert tax solutions for individuals living abroad, ensuring compliance and optimization of your global financial obligations.

Non-Resident Tax Services

Tailored support to manage your tax responsibilities globally, keeping you compliant and informed while living overseas.

ITN

Apply for Individual Tax Number (ITN) or Temporary Tax Number (TTN).

NRK

To apply for a representative for a non-resident tax (NRK) account for withholding tax purposes.

NR4

Prepare and file NR4 Canadian tax slip and summary for non-residents.

NR6

Prepare and file NR6 Canadian tax slip and summary for non-residents.

Rental Income

If you earned rental income in Canada, you have to report it to CRA.

UHT

Prepare and file an Underused Housing Tax return for non-Canadian PRs or citizens.

Income Tax

Filing

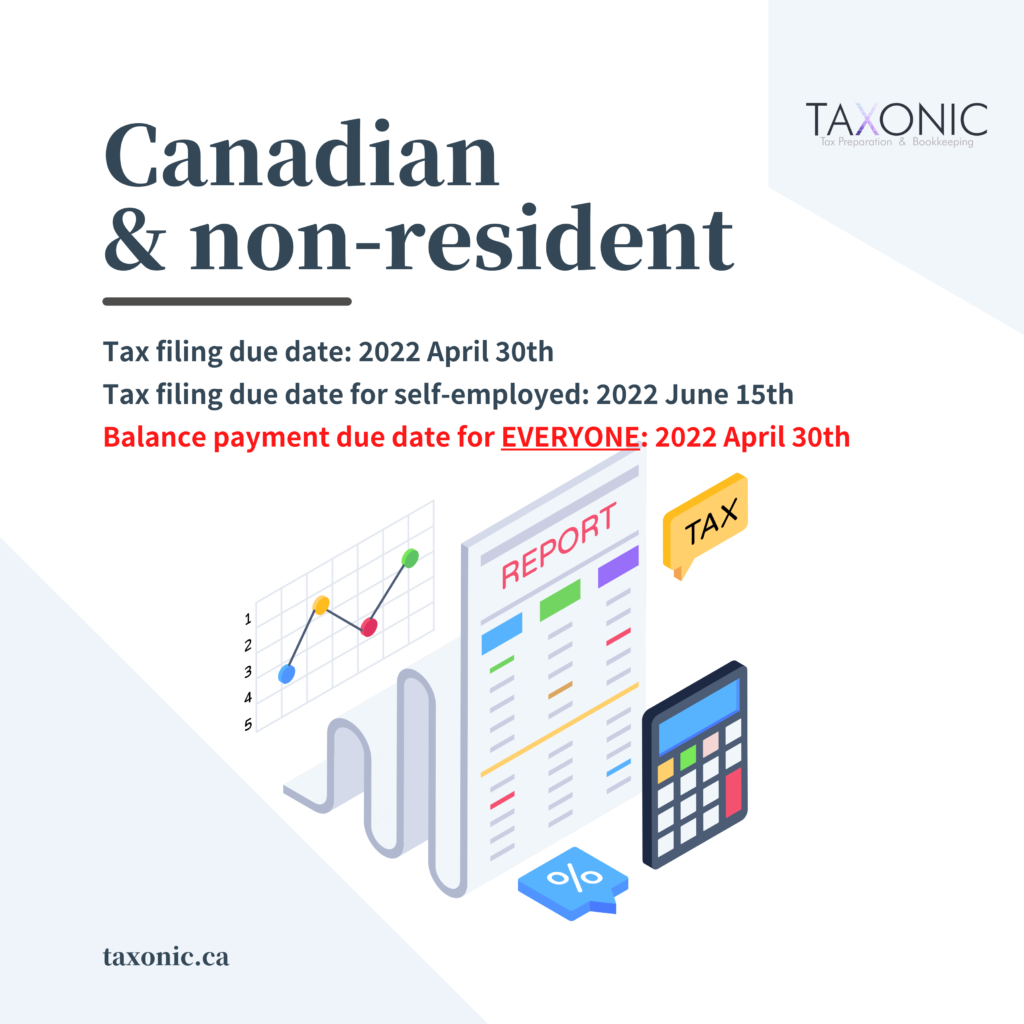

Non-residents must file a tax return by Apr 30 of the year following the year in which the disposition of property took place.

Certificate of Compliance

Non-residents must notify the CRA about the proposed disposition of, or the completed disposition of, certain taxable Canadian property.

Have a

complicated case?

For any unique or specialized cases, feel free to contact us and let our experienced team find the right solution for you.

Got Questions?

Expertly navigate your Canadian tax obligations while living abroad with our concise, specialized non-resident services.

- Decided to move abroad?

- Own a Canadian property?

- Earned Canadian rental income?

- Sold assets before leaving?