Personal Taxes

Rely on our proficiency in managing personal taxes for both Canadian residents and non-residents, ensuring accurate and compliant tax filings.

File Your Taxes Online

Simplify your tax filing with our easy, secure online process,

ensuring a seamless and worry-free experience.

Information

Fill out your information using our pre-set Information Forms.

Authorization

Authorize us as your CRA representative using a secure e-signature.

Documents

Provide us your complete tax documents for the tax year.

Payment

Confirm and make a payment in full for your serviced invoice(s).

Confirmation

Confirm the tax return result and approve for submission.

Determine Your Residency Status

Identify your residency status to unlock customized tax solutions designed to meet your specific financial needs. Residency status for income tax purposes is different from immigration status.

FAQ

Delve into our Personal Tax Filing FAQ for helpful answers and guidance on navigating the tax filing process with ease.

You have to file a tax return if you gained income during the tax, and would like to claim a refund. See details.

It depends on each case. Some get refunds, some have to pay tax. We provide a return summary before filing so you will have an overall idea about your return. Talk to us so we can learn more about your case.

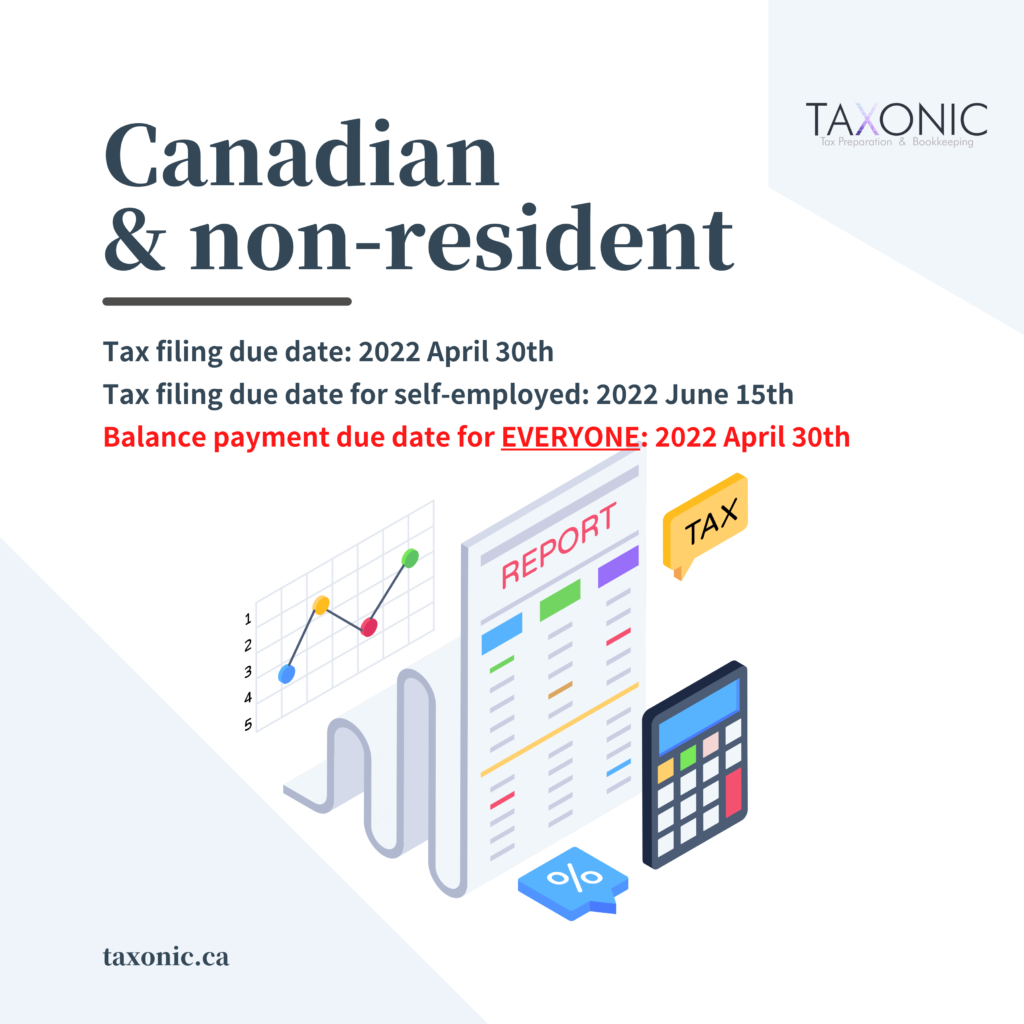

Normally the due date is on April 30th each year for the majority, while it’s on June 15th for self-employed people. See details.

Yes, you are allowed to file your previous tax returns for up to 10 years. You may have late filing penalties if you owe taxes.

Yes. You have the option to file your taxes over email or through our secure portal. See how.

We have prepared a general checklist for individual tax returns. For complex cases, please contact us.

Yes. For every tax return we prepared, your signature is required before we submit your return.

You can but you don’t have to. We send out legally binding eSignatures to your email address.

We charge based on the complexity of each case. Our base rate for personal tax return is $45/tax return, which includes one T slip or one item. View details.

For online payment we accept email transfer and Wechat/Alipay. For in-person payment, you can pay by debit/credit card.

A service invoice will be sent once your tax return is prepared. You tax return will be submitted once payment is received.