The Canada Emergency Wage Subsidy, Canada Emergency Rent Subsidy, and Lockdown Support have come to an end. The Department of Finance Canada has proposed two new subsidies and an extension to a existing benefit in October to help businesses seriously affected by Covid-19.

Tourism and Hospitality Recovery Program

Who can apply?

The program is targeting eligible organizations in the tourism and hospitality industry. For example: hotels, restaurants, bars, festivals, travel agencies, tour operators, convention centres, convention and trade show organizers, etc. To see the full list.

Program start date: Oct 24th, 2021

Program end date: May 7th, 2022

Qualifications: (must meet both)

- Experienced an average monthly revenue drop of at least 40 percent over the first 13 qualifying periods for the Canada Emergency Wage Subsidy. That is from March 2020 to February 2021; and

- Experienced a current-month revenue drop of at least 40 percent.

What’s the rate?

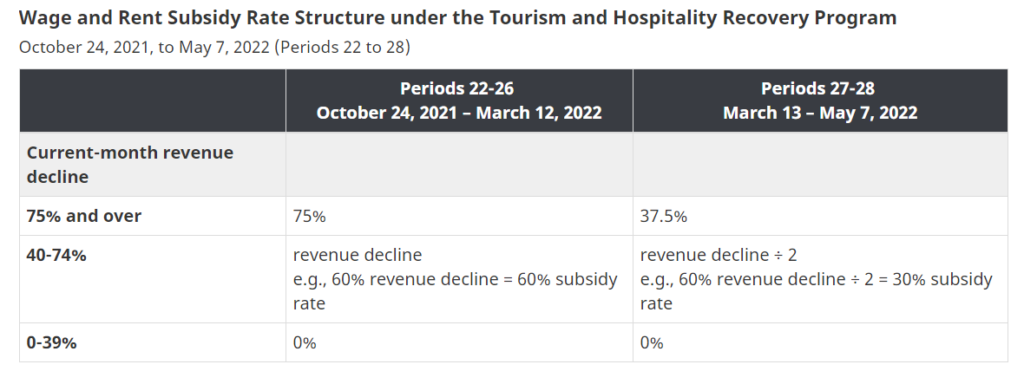

From Oct 24th, 2021 to Mar 12th, 2022, eligible business will be able to apply from a minimum of 40% to a maximum of 75% of their wage and rent expenses.

From Mar 13th, 2022 to May 7th, 2022, eligible business will be able to apply from a minimum of 20% to a maximum of 37.5% of their wage and rent expenses.

During Oct 24th, 2021 to May 7th, 2022, if there is a public lockdown order, eligible businesses will be able to apply for an extra of 25% support, calculated by the number of days.

Department of Finance Canada has provided the following calculation table.

Hardest-Hit Business Recovery Program

Who can apply?

The program is aiming to help businesses whose been deeply hit by Covid-19 and are not qualified for the Tourism and Hospitality Recovery Program.

Program start date: Oct 24th, 2021

Program end date: May 7th, 2022

Qualifications: (must meet both)

- Experienced an average monthly revenue drop of at least 50 percent over the first 13 qualifying periods for the Canada Emergency Wage Subsidy. That is from March 2020 to February 2021; and

- Experienced a current-month revenue drop of at least 50 percent.

What’s the rate?

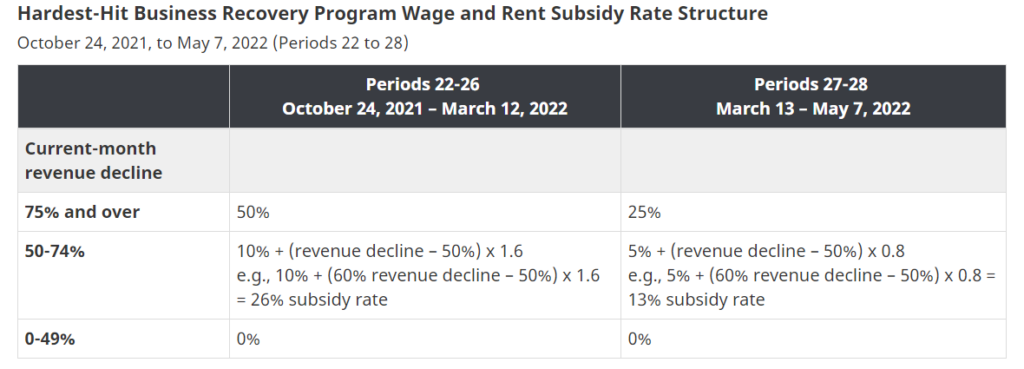

From Oct 24th, 2021 to Mar 12th, 2022, eligible business will be able to apply for a maximum of 50% of their wage and rent expenses.

From Mar 13th, 2022 to May 7th, 2022, eligible business will be able to apply for a maximum of 25% of their wage and rent expenses.

During Oct 24th, 2021 to May 7th, 2022, eligible businesses will be able to apply for an extra of 25% support if affected by public health restrictions. Benefit is calculated based on the number of days.

Department of Finance Canada has provided the following calculation table.

The Canada Recovery Hiring Program

The program is extended from Nov 20, 2021 to May 7, 2022. The base period remains the same, which is the period of March 14 to April 10, 2021.

Program rate for period October 24 to November 20, 2021 is increased to a maximum of 50%.