CRA官方在线付款链接:https://apps.cra-arc.gc.ca/ebci/fppp/mypymnt/pub/ntr.action?request_locale=en_CA

CRA在线付款六步

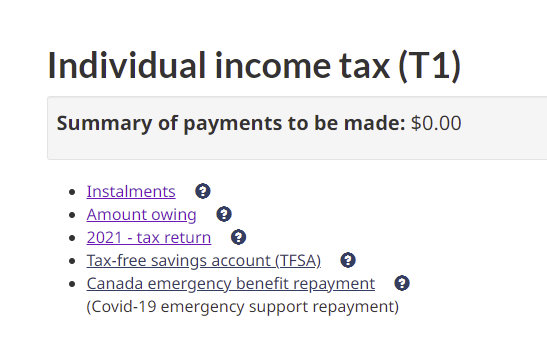

- 选择 Individual income tax (T1)

- 这里我们以 2021 – tax return 为例

- 填写信息

- 确认所付账户,SIN,税务年度,和金额

- 了解并选择支付方式,输入登录信息或卡号

- 付款成功,保存付款记录

Instalments: 用于支付个人所得税分期付款。

Amount owing: 用于支付未付清的税款。

2021 – tax reutn: 用于支付2021税务年度按时申报时的税款。

Tax-freesavingsaccount (TFSA): 用于支付TFSA还款。

Canada emergency benefit repayment: 用于支付疫情补贴/福利还款。

💡其他企业付款方式请参考CRA官网。有任何付款问题,请致电1-800-959-8281。