你在报税的时候是不是也遇到过这样的问题:我不知道我有没有这个税单。比如银行利息T5税单。通常当该税务年度的利息收入大于50加币的时候,银行才会提供税单。但是很多人不确定自己到底有多少利息。又或者当年有买卖RRSP,但是自己不确定具体时间和金额。或者是炒股的朋友们,不确定是否收到了T5008? 遇到这种情况的朋友们,可以通过登录自己的CRA账户,查看并下载税单。

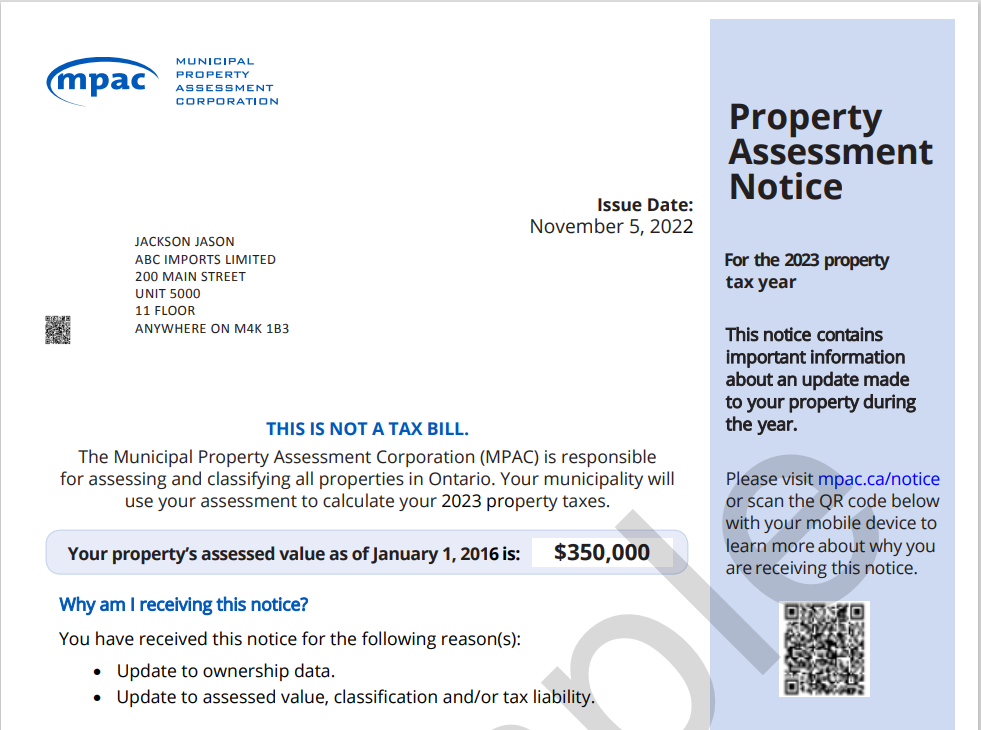

第一步

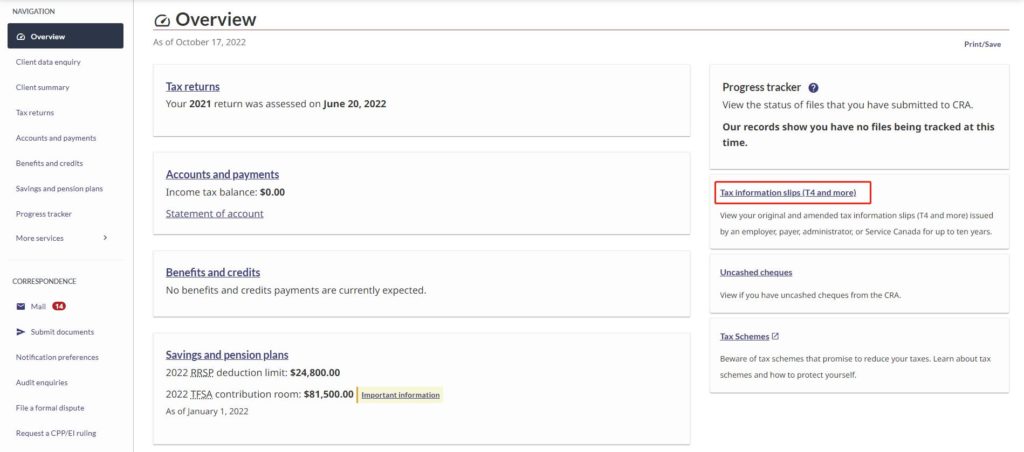

第二步

登录后,在页面右边找到 Tax information slips (T4 and more)

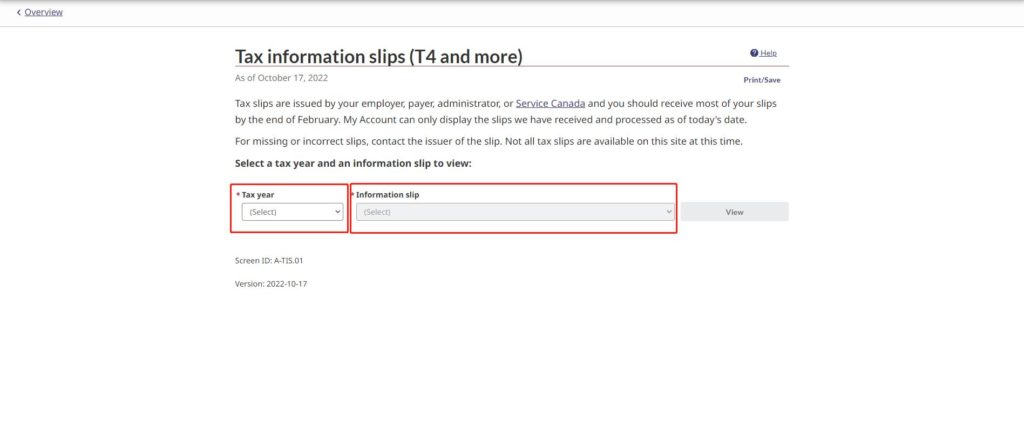

第三步

选择税务年度 Tax year 以及所有税单 All slips, 选择下一步 Next

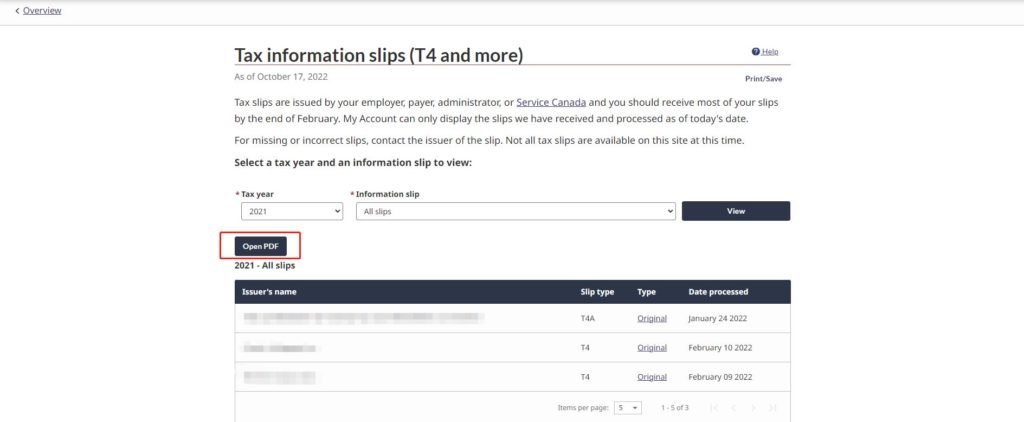

第四步

这里会显示该税务年度的所有税单,点击 Open PDF

第五步

选择保存路径,确认文件名和文件格式。

需要注意的是,有时候并不是所有税单都会在CRA账户中及时显示。所以不要过于依赖CRA账户,手中的纸质税单同样重要!