Being the recipient of a CRA review letter might induce feelings of anxiety and confusion. However, with the right guidance, navigating these complex waters doesn’t need to be a daunting task.

Canada Revenue Agency (CRA) review letters are standard part of the CRA’s due diligence to ensure the integrity of the tax system. They are usually dispatched to request additional information or clarification on tax return elements. This article aims to guide you, our esteemed client, on the appropriate actions to take when you receive a CRA review letter.

Step 1 Review the Letter Carefully

Receiving a CRA review letter does not automatically imply wrongdoing on your part. The CRA routinely sends out review letters as part of its tax assessment process. Understand that it is typically a request for additional information to verify the credits or deductions you’ve claimed.

The CRA review letter contains specific information regarding what the CRA wants to verify in your tax return. It is crucial to thoroughly read the letter, comprehend its content, and determine the requested information or documents. Here are some common subjects.

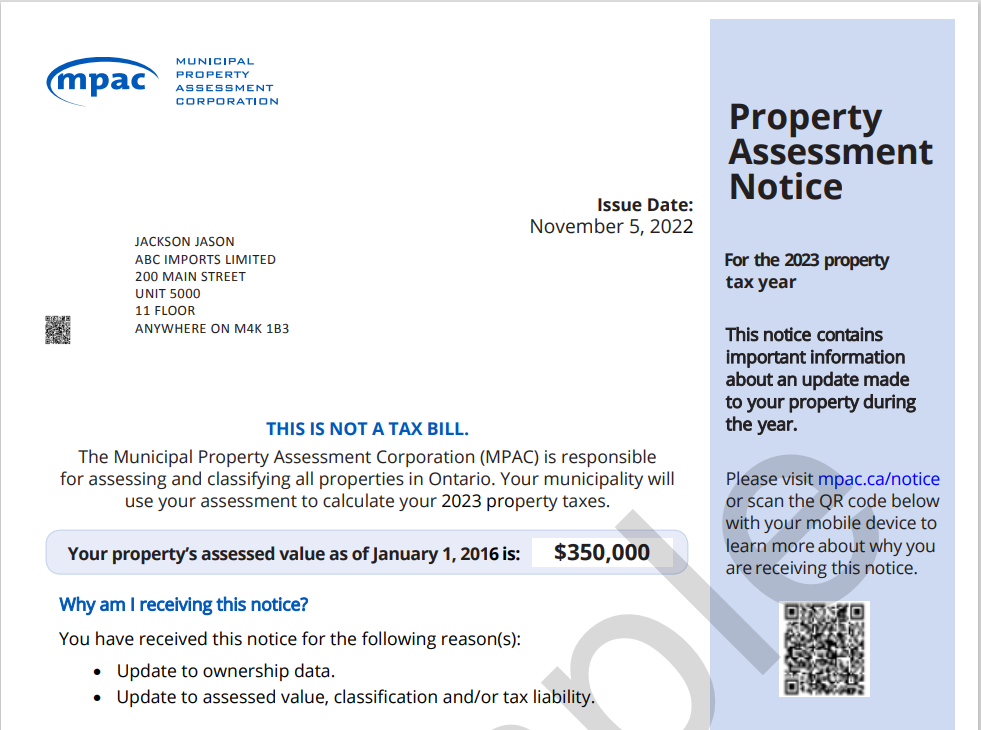

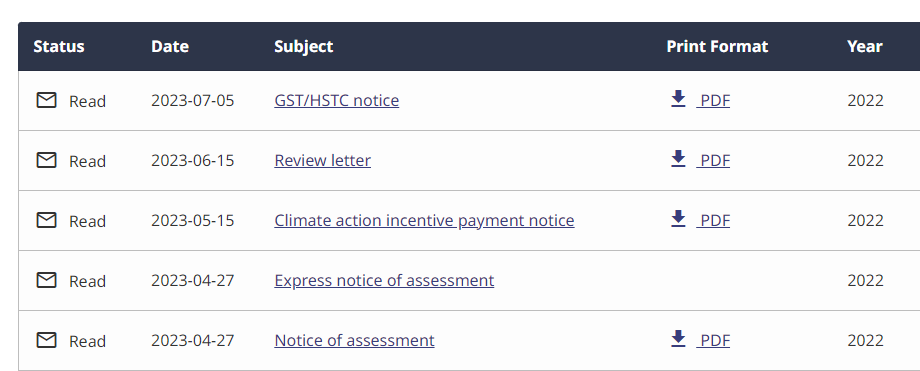

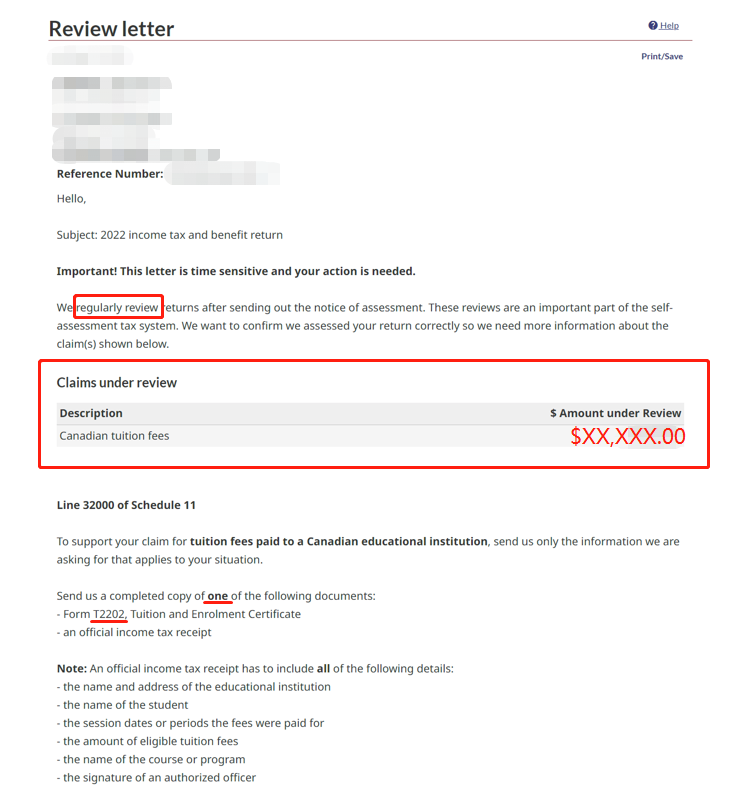

NOA and Express NOA

Usually you do not need to respond to a NOA unless you disagree with CRA assessment.

Review Letter

Review letters usually have to be replied to within 30 days. Common subjects that are more likely to be reviewed are tuition, rent/property tax, medical expenses, etc. A review letter often comes with a case number or reference number. Below is an example of a review letter, asking the client to submit tuition record for the 2022 tax year.

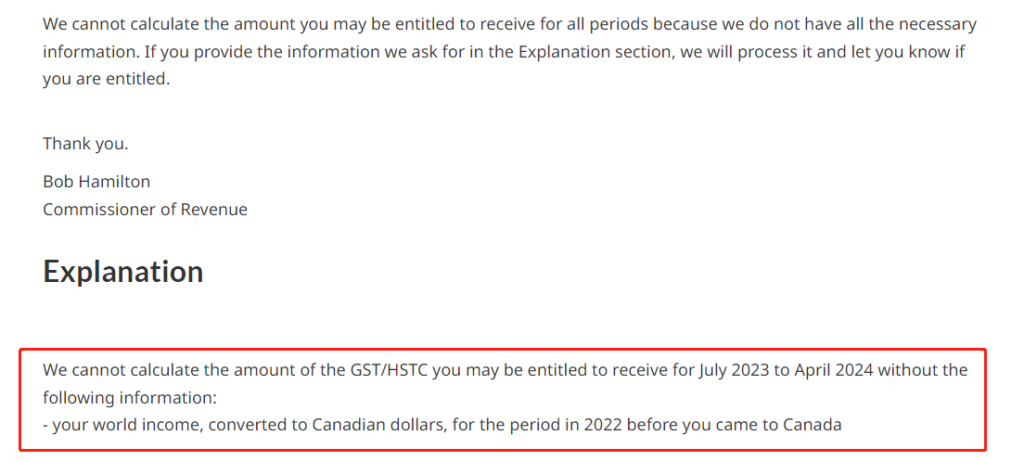

Benefit Notice

Benefit notices sometimes contain requests that need to be responded. Here is an example of the GST/HSTC notice, asking for world income information.

Step 2 Gather Your Documents

Once you’ve identified what the CRA is asking for, the next step is to gather these documents. These may include receipts, legal documents, logs, or financial statements that support your tax claims. The letter will outline exactly what is required.

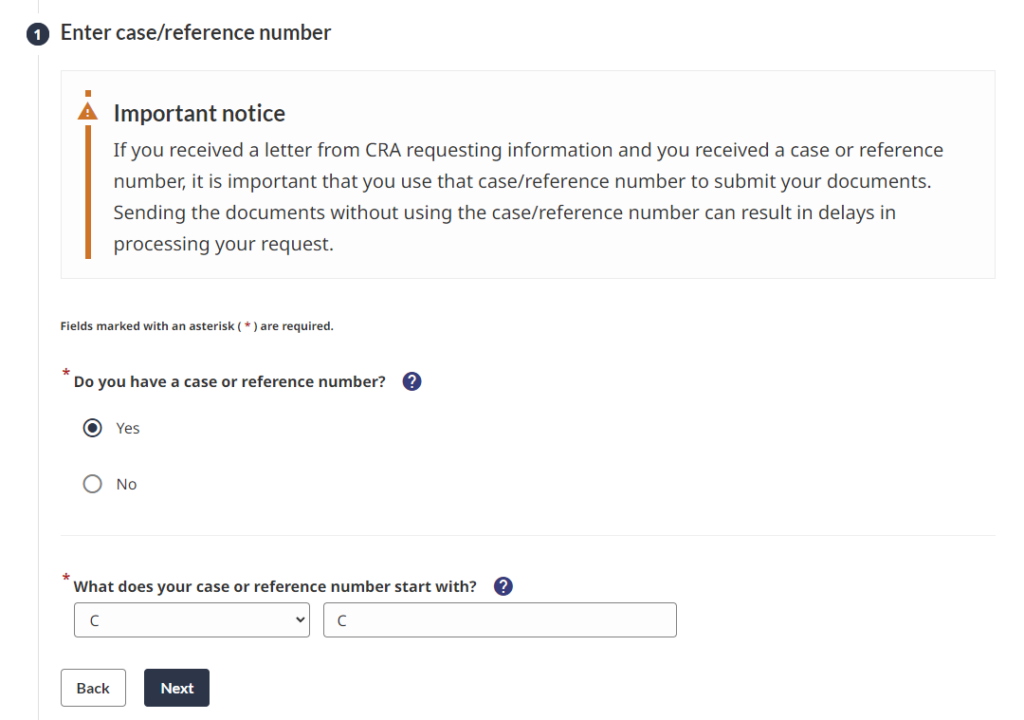

Steps to respond online to your REVIEW LETTER:

- Log in CRA MyAccount, and select “Submit documents” on the left side of the page.

- Again, select “Submit Documents”.

- “Do you have a case or reference number?” Select ” Yes”.

- Upload your prepared documents.

- Save the confirmation page for future reference.

To respond to WORLD INCOME, there are two options:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- The fastest way: call CRA directly at 1-800-387-1193, or

- Write your response in WORD or NOTE, and upload via your CRA account with the following steps.

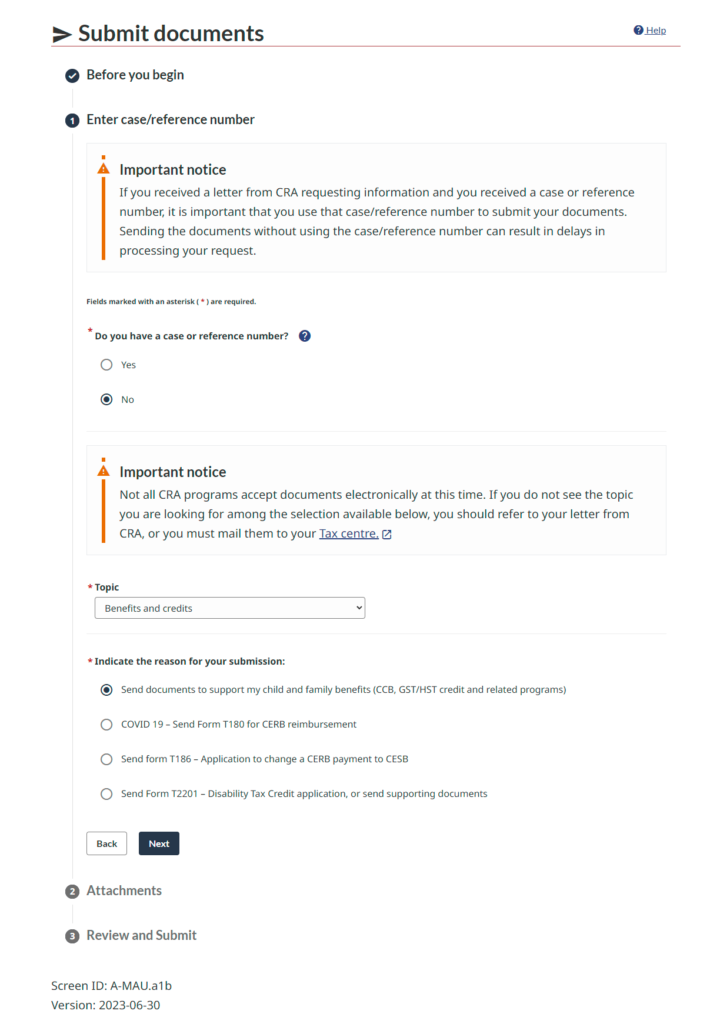

1. Log in CRA MyAccount, and select “Submit documents” on the left side of the page.

2. Again, select “Submit Documents”.

3. Select no reference number, shown in the picture below.

4. Upload your prepared documents. - 5. Save the confirmation page for future reference.

I will use the above case (2022 GST/HST notice) as an example.

If you had ZERO income, you could reply:

To whom it may concern,

I received a GST/HSTC notice letter, asking me to provide my world income, converted to Canadian dollars, for the period in 2022 before I came to Canada. Here is my response.

I do not have any income for the period in 2022 before I came to Canada.

Please let me know if you need anything else.

Regards,

XXX

If you had SOME income, you could reply:

To whom it may concern,

I received a GST/HSTC notice letter, asking me to provide my world income, converted to Canadian dollars, for the period in 2022 before I came to Canada. Here is my response.

I came to Canada and became a Canadian resident for tax purposes on July 1st, 2022. I earned xxxxx CNY (China Yuan) in 2022 before coming to Canada, converted to Canadian Dollars, which is $xxxxx CAD, calculated using the average 2022 exchange rate of 0.19 provided by CRA.

Please let me know if you need anything else.

Regards,

XXX

Step 3 Reply Before the Deadline

Typically, the response time for the Review Letter is 30 days. While there is no specific time frame given for responding to the Benefit Notice, benefits will only be issued once the CRA has processed the response. Therefore, it is advisable to reply as soon as the letter is received.

Step 4 Consider Professional Help

If you are confused about CRA’s requirements or are unsure about how to prepare the documents, you might want to consider seeking assistance from a professional tax advisor or accountant.

Step 5 Communication

If you are not able to submit the required documents before the deadline, or need more time to prepare, it’s recommended that you contact CRA as soon as possible to explain the situation and request an extension. Additionally, keep all records of communication with the CRA, including sent letters and emails, as well as any responses received. Maintain copies of all documents you submit. This way, if there are any issues or disputes, you will have a complete record to refer to.

No matter how familiar one is with taxation, annual tax filing is an important responsibility. Receiving an audit letter from the CRA is not something to fear. By following the right steps and seeking professional help when needed, you can handle it smoothly. I hope this article helps everyone better understand how to deal with CRA’s audit letters. If you have any other questions, feel free to contact us.