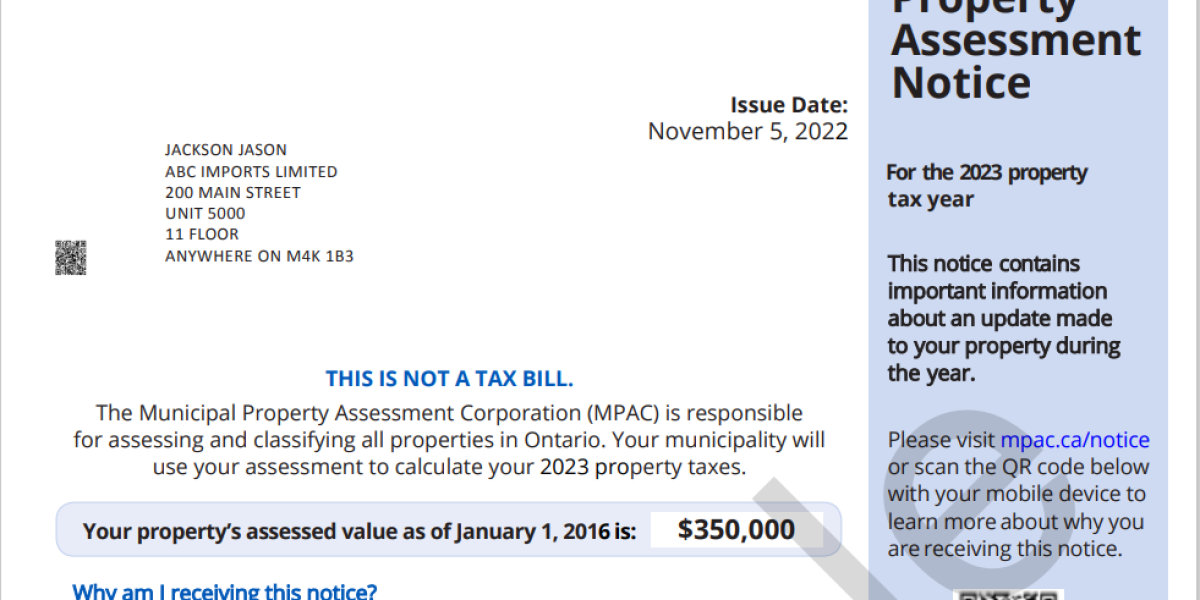

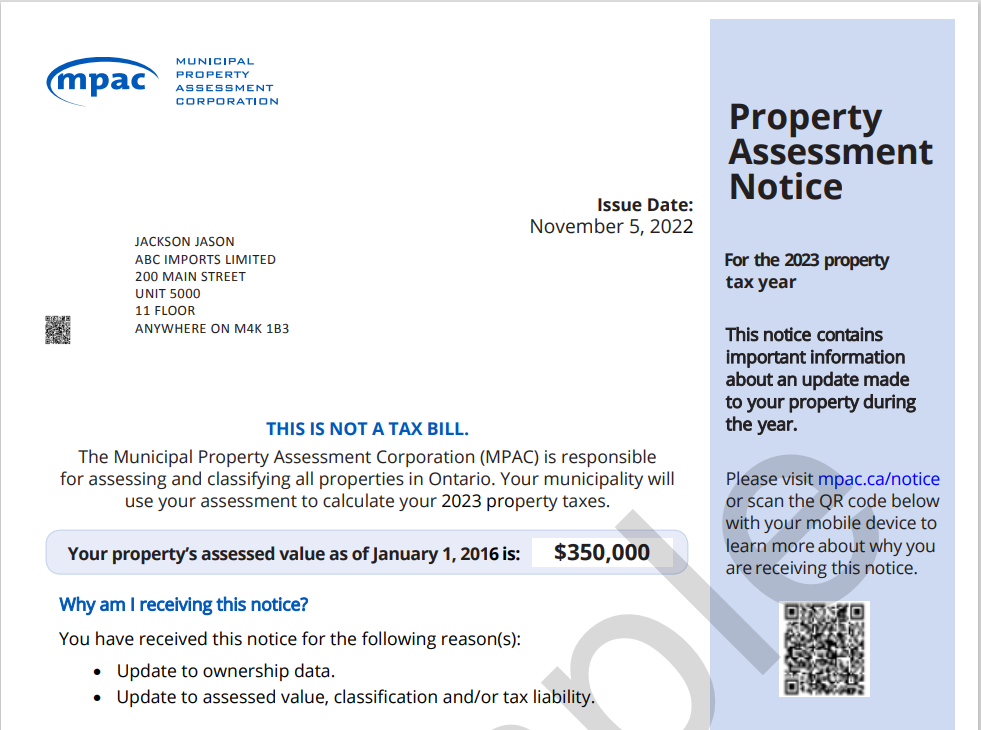

The “Property Assessment Notice” is issued by MPAC. MPAC is an independent, non-profit public corporation responsible for assessing residential, commercial, and other types of properties for all municipal regions in Ontario. The property assessment data it provides is based on a range of market and property characteristics, such as location, building area, year of construction, and so on.

The Property Assessment Notice contains valuation data about your property, which can be used for declaring the federal Underused Housing Tax (UHT).

Today, we will introduce how to retrieve it if you haven’t received or have lost the physical Property Assessment Notice.

How to find Ontario Property Assessment Notice online

You may call MPAC at 1-866-296-6722 to get help, but online chat is probably the fastest way. Here is how.

- Find your property roll number.

- Get ready your personal information such as full name, date of birth and address, etc.

- Connect with a live chat via MPAC and obtain ACCESS KEY. Click to visit live chat

Just simple let the agent know that “I‘d like to register AboutMyproperty account but I could’t find my access code, please help.” - Once you receive the ASSESS KEY, you may go ahead and register the AboutMyProperty account. Click to visit the page

- Activate your account by confirming your email address.

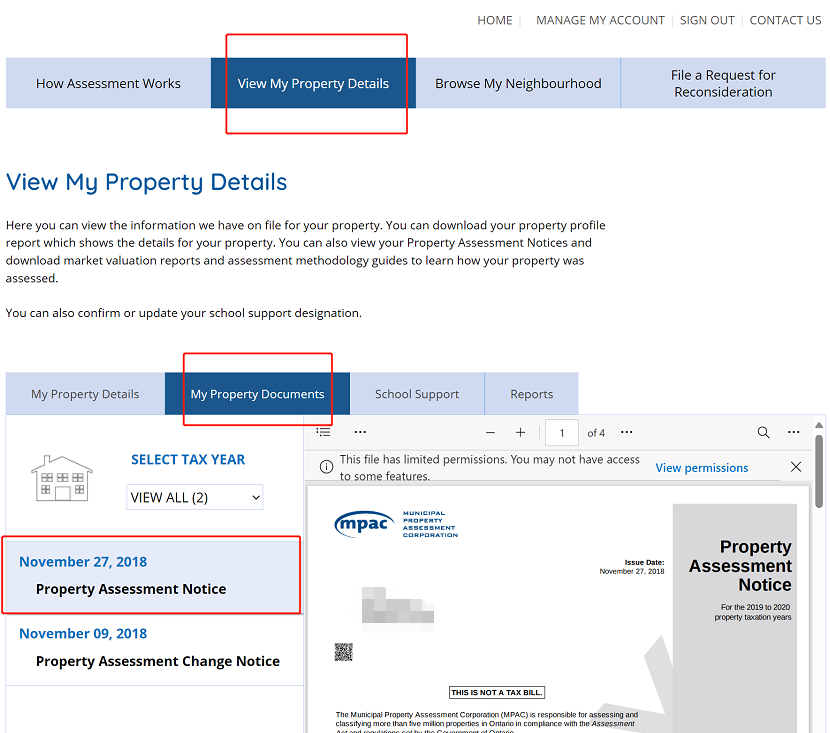

- Once you log in your account, you will find “My Property Documents” under “View My Property Details” page.

- Download and save the latest Property Assessment Notice.

💡 Understanding the valuation of your property not only helps you plan your taxes effectively but also ensures that your rights and interests are not compromised. If you have any questions or need assistance, feel free to contact MPAC or consult a professional. We hope this article provides you with some useful information.