Have you ever got this question when preparing for your tax filing: am I supposed to receive the slip? For example, if you have an annual interest of $50 CAD or more, you will likely receive a T5 slip from your bank. But the question is, do you really know how much interest you earned this year? Another example is, if you contributed or withdrew RRSP from your account, do you remember the exact amount and date for each transaction? Or for those of you who were in the stock market, have you received your T5008? In today’s video, we will talk about how you can find your slips from your CRA account.

Step One

you will need to have a cra my account. If you haven’t registered an account yet, please visit the link to find out more.

Step Two

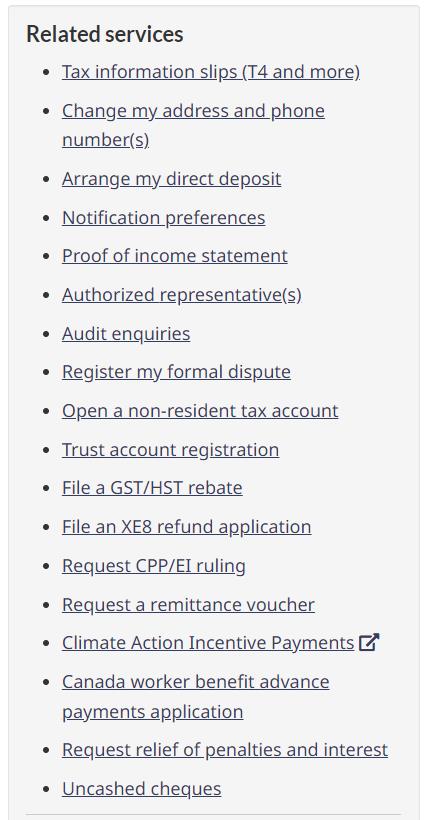

Once logged in, you will find Tax information slips (T4 and more) under Related services section on the bottom right of the page.

Step Three

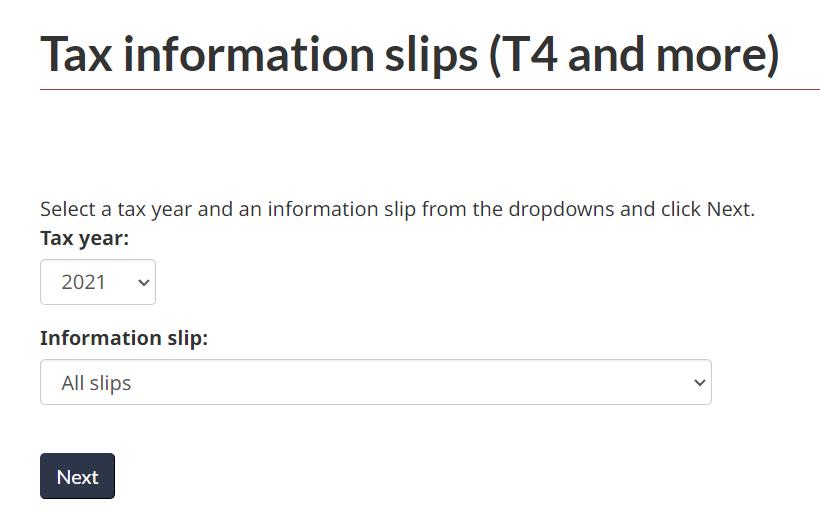

Select the tax year and all slips, then click next.

Step Four

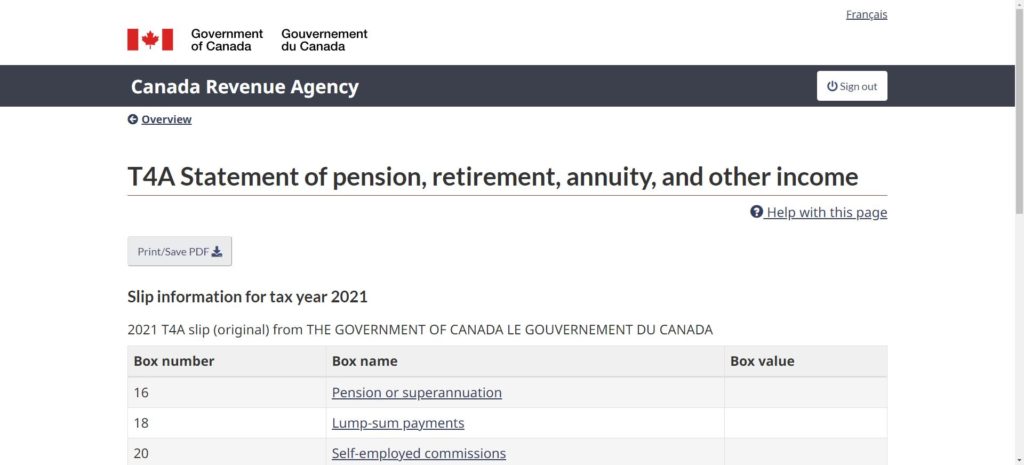

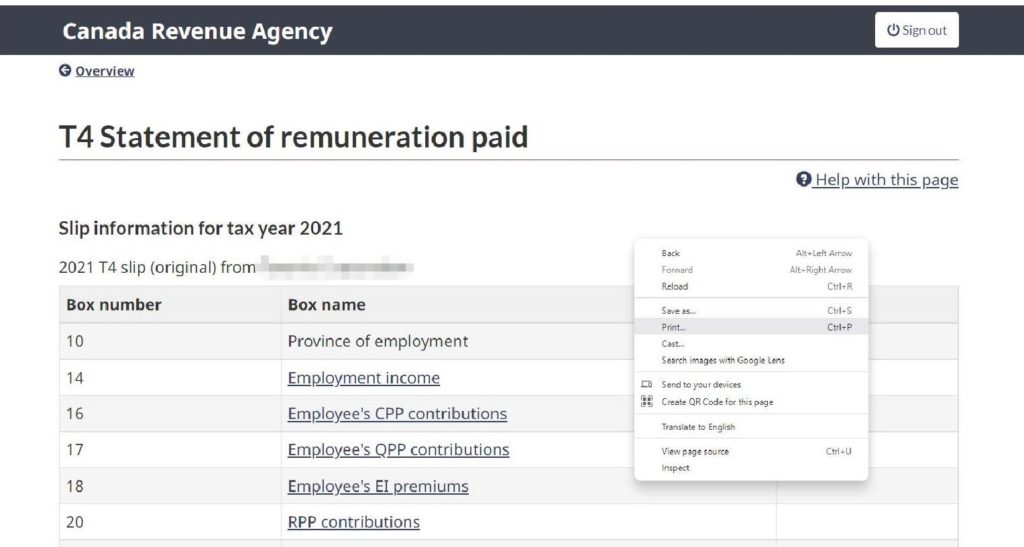

Here you will see all slips you have for the tax year you selected. Click slip type to view the slip details.

Step Five

Click Print/Save PDF, and repeat the process until you saved all your slips.

If you don’t see the Print/Save PDF button, you may right click the page, and select print, and then print to PDF.

Please note that sometimes not all your slips were uploaded on time to CRA , so it is the same important to have a digital or hard copy of the slips from the employers, organizations or institutions.