Have you recently set foot on the land of opportunities that is Canada, or are you in the process of planning a migration to this country? Regardless of your situation, understanding the tax system in Canada and the benefits of filing taxes are crucial aspects of living in Canada. Today, let us delve into the tax-filing system in Canada and the advantages it holds for newcomers.

First off, let's define who qualifies as a newcomer:

- Permanent residents (including those who have received a CoPR letter or PR card)

- Refugees

- Temporary residents (including individuals with study or work visas, or those holding temporary residence permits)

For the Canada Revenue Agency (CRA), during your first year of residence in Canada, normally you are considered a newcomer for tax purposes. Note that your immigration status is not synonymous with your tax status.

Typically, upon arrival in Canada, you would begin to establish various ties, including:

- Holding property or a residence in Canada

- Having your spouse and/or children in Canada

- Possessing personal assets within Canada, such as a car, or having purchased furniture

- Establishing social ties in Canada, like joining religious or other organizations

- Establishing economic ties in Canada, such as opening a bank account or obtaining a credit card

- Holding a Canadian driver’s license

- Obtaining a Canadian passport

- Securing Canadian health insurance, like OHIP

What preparations should newcomers make after arrival?

- Obtain a Social Insurance Number (SIN), which can be done either online or offline. Do not have a SIN yet? Visit Service Canada to apply online: Apply SIN online

- Apply for benefits like:

- GST/HST Credit

- Climate Action Incentive

- Child Care Benefit

- Other provincial benefits

- Set up banking information for CRA payments. Call CRA at 1-800-959-8281 or set it up online with your financial institution.

- File personal income tax. Generally, you need to file taxes when you owe taxes or wish to receive benefits. Download our T1 checklist here.

- Beware of tax scams! The CRA rarely contacts taxpayers via text messages and will never threaten taxpayers. For more details, visit the CRA fraud prevention page.

Benefits of filing taxes for newcomers:

- Reclaiming Overpaid Taxes: Sometimes, the tax deducted from your wages may be more than what you owe. In such cases, filing taxes allows you to reconcile your tax payment: if too little was deducted, you can pay the owed taxes; if too much was deducted, you can claim a refund. Especially for newcomers who might have unstable employment initially, there’s a higher chance to enjoy the benefit of tax refunds.

- Access to Government Benefits: Did you know that filing taxes can qualify you for several government benefits like Canada Child Benefit, GST/HST Credit, Housing Benefit, and other low-income family benefits? Even if you had no income in a year, as long as you filed your taxes, you might still receive benefits from the government.

- Saving for the Future: Filing taxes can increase your Registered Retirement Savings Plan (RRSP) contribution room. This is akin to having a larger piggy bank, providing more space to save for the future. Moreover, money deposited in your RRSP can reduce your taxable income at tax time, meaning you pay less tax.

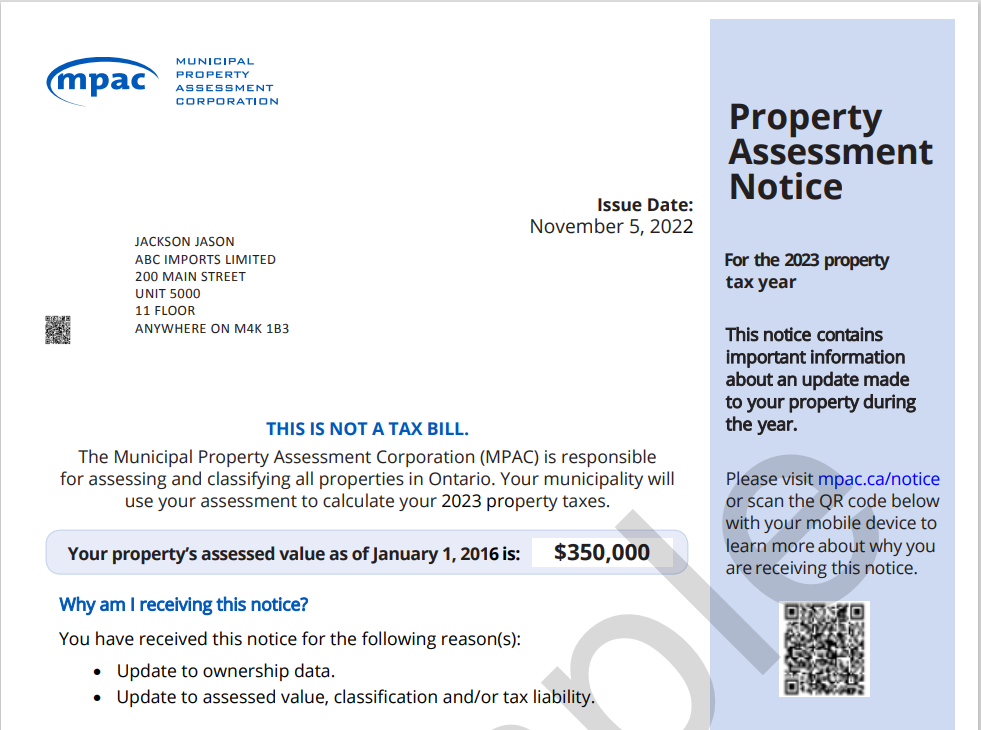

- Improved Loan Approval Rates: Filing taxes can enhance your chances of approval when applying for loans or credit cards as banks review your Notice of Assessment (NOA) to evaluate your income situation. If you have a consistent record of filing taxes, it demonstrates a stable income.

- Access to Student Loans and Scholarships: If you plan to pursue further education, filing taxes is essential. Many student loans and scholarships require viewing your Notice of Assessment.

Whether you are a newcomer or have been living in Canada for a while, we hope that through this article, you gain a better understanding of the benefits of filing taxes. Be reminded that the deadline for personal income tax filing is April 30th each year (or June 15th under special circumstances). For assistance, please feel free to contact us.